Credit Cards

Find Your Perfect Visa Credit Card

Explore our range of Visa credit cards, including Classic, Platinum, Signature, and Business, with no annual fees and exclusive benefits tailored to your needs.

Explore our range of Visa credit cards, including Classic, Platinum, Signature, and Business, with no annual fees and exclusive benefits tailored to your needs.

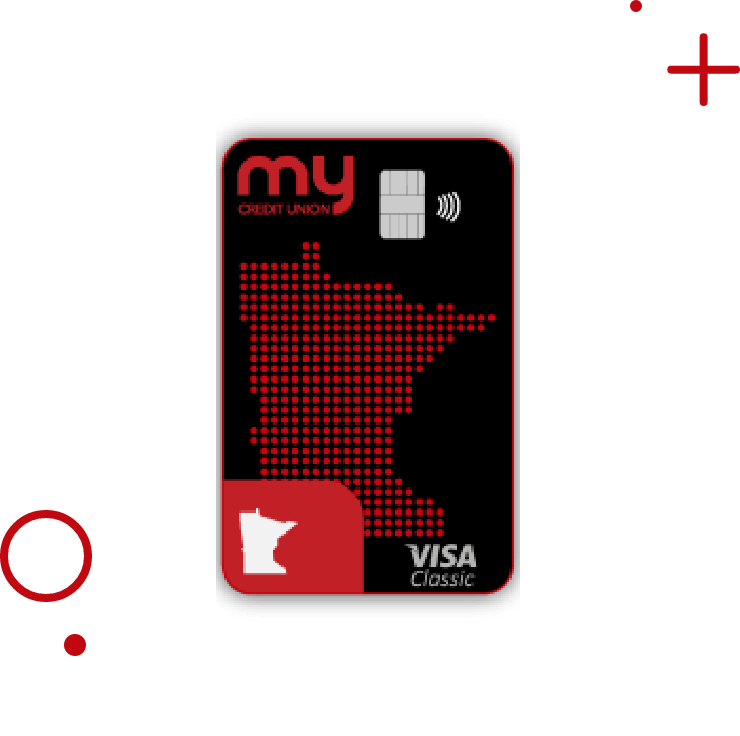

Our No Annual Fee Visa Classic credit card has a slightly higher annual percentage rate than our Visa Platinum card. The Classic card has a 25-day grace period on all new purchases when your account is paid in full each month. (Cash advances accrue interest from the date an advance is made.)

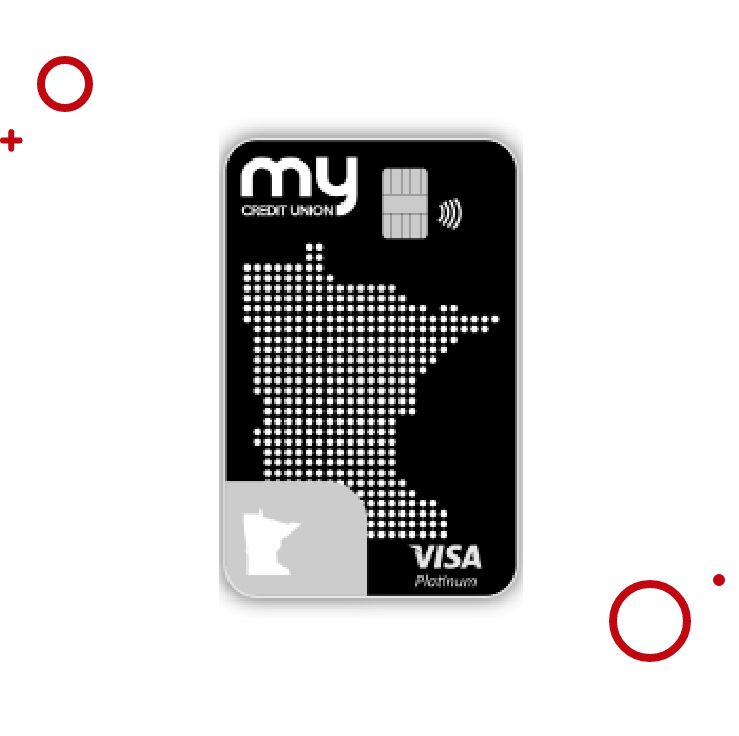

Our No Annual Fee Visa Platinum credit card has a low annual percentage rate and a 25-day grace period on all new purchases when your account is paid off each month. (Cash advances accrue interest from the date an advance is made.)

Our No Annual Fee Visa Signature credit card is a great card for traveling and offers a cash back option. The Signature card has a 25-day grace period on all new purchases when your account is paid in full each month. (Cash advances accrue interest from the date an advance is made.)

Our No Annual Fee Visa Business credit card is a great option for our business members. The Business card has a 25-day grace period on all new purchases when your account is paid in full each month. (Cash advances accrue interest from the date an advance is made.)

You can start earning points toward premium merchandise or exciting travel plans just by using your MY CREDIT UNION consumer credit card.

Every time you spend, each dollar earns one (1) point. Points in the CU Rewards Program remain in your account for five (5) full calendar years before they expire, giving you plenty of time to save up for the merchandise or travel reward that you want!

To view or redeem your CU Rewards points, please log into Online Banking.